How We Got Here

Key Takeaways

- The annual U.S. debt-to-GDP ratio reached 120% in 2024, exceeding levels last seen immediately following World War II.

- At the most basic level, federal expenditures consistently outpace revenue, driving continued debt growth. Given that federal receipts bounce between 15% and 20% of GDP, in the long-term spending in excess of 20% of GDP is simply not sustainable.

- The growth of federal debt transcends party lines, driven by major events and policy decisions across administrations.

The United States federal government's debt has grown to over $36 trillion, and the debt-to-GDP ratio is hitting levels not seen since the immediate aftermath of World War II. While there was a brief period in the late 1990s and early 2000s when federal revenues outpaced expenditures, the 2000s and preceding saw rapid debt accumulation.

Gross Federal Debt as Percent of GDP

Annual data (1939-2024)

The gap between federal revenue and expenditures has widened significantly since the 1960s, with major expansions occurring during economic crises and the implementation of large federal programs. Federal receipts have historically ranged between 15.4% and 20.4% of GDP, with the lowest point during the 2008-2009 financial crisis and the peak during the dot-com boom of 2000. Despite this relatively stable range in revenue collection, the introduction of Medicare and Medicaid in 1965 marked a structural shift in federal spending patterns. More recently, responses to the 2008 financial crisis and the COVID-19 pandemic have led to unprecedented levels of federal expenditure, while revenue remains flat as a share of GDP. In dollar terms, both revenue and spending have grown substantially, but spending has consistently outpaced revenue collection, contributing to the steady accumulation of federal debt.

Federal Expenditures and Receipts

Quarterly data (1947-2024)

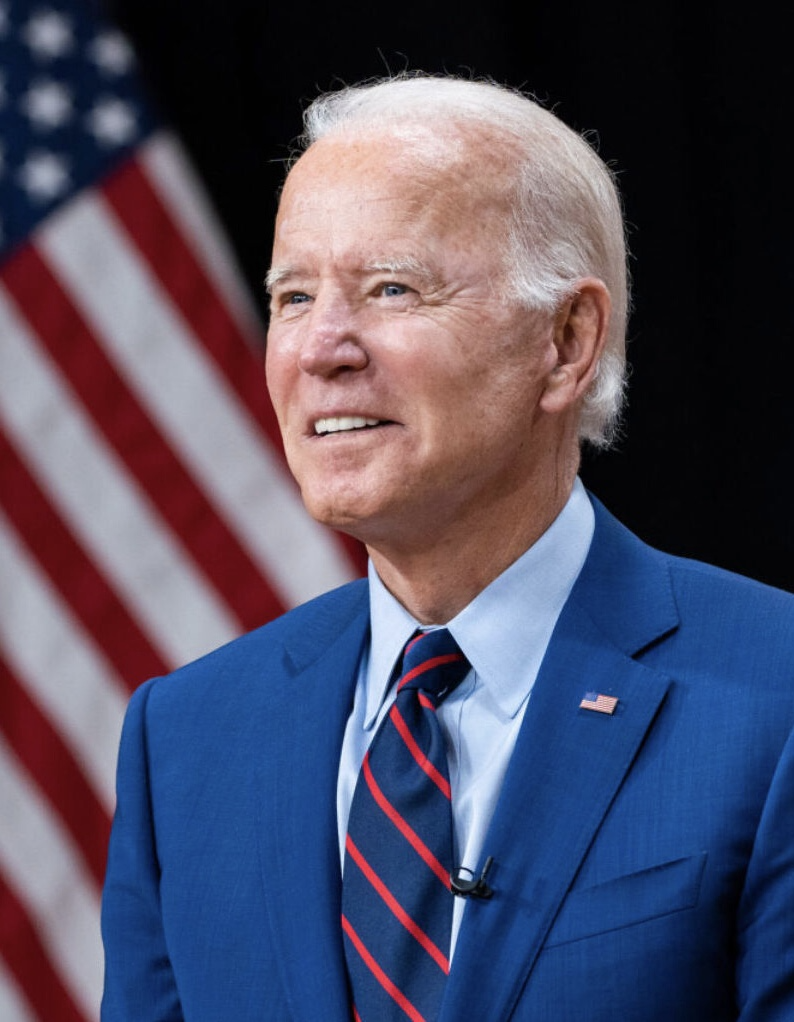

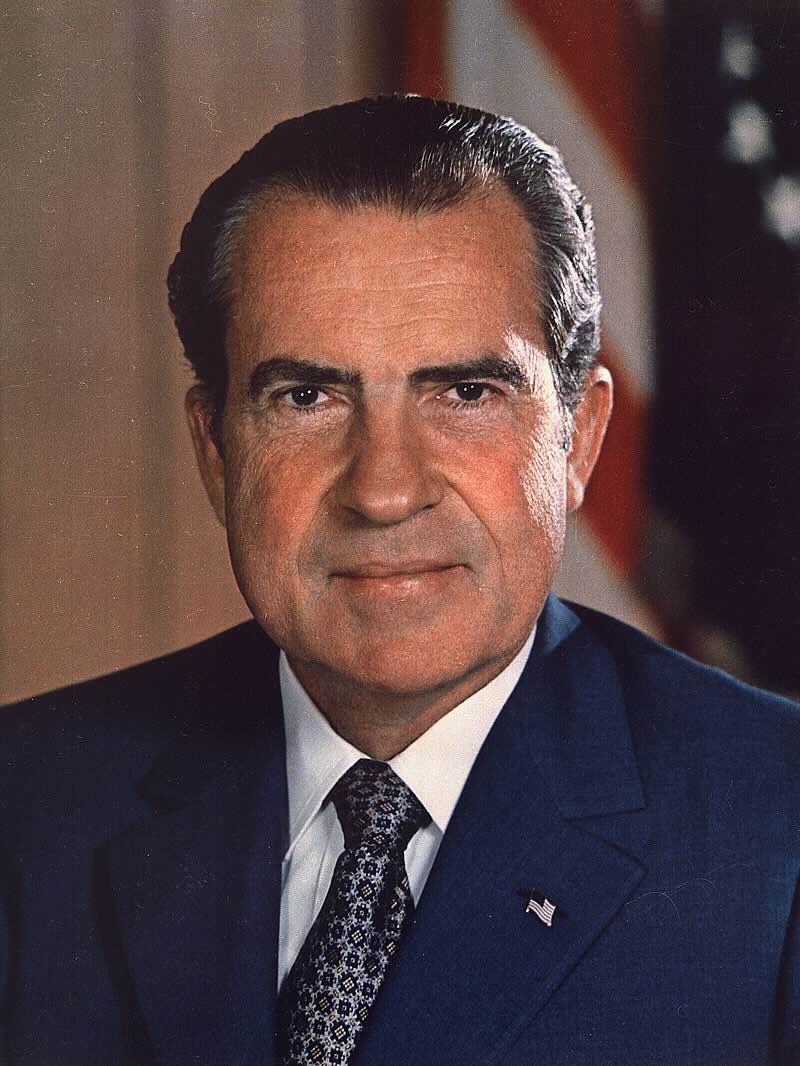

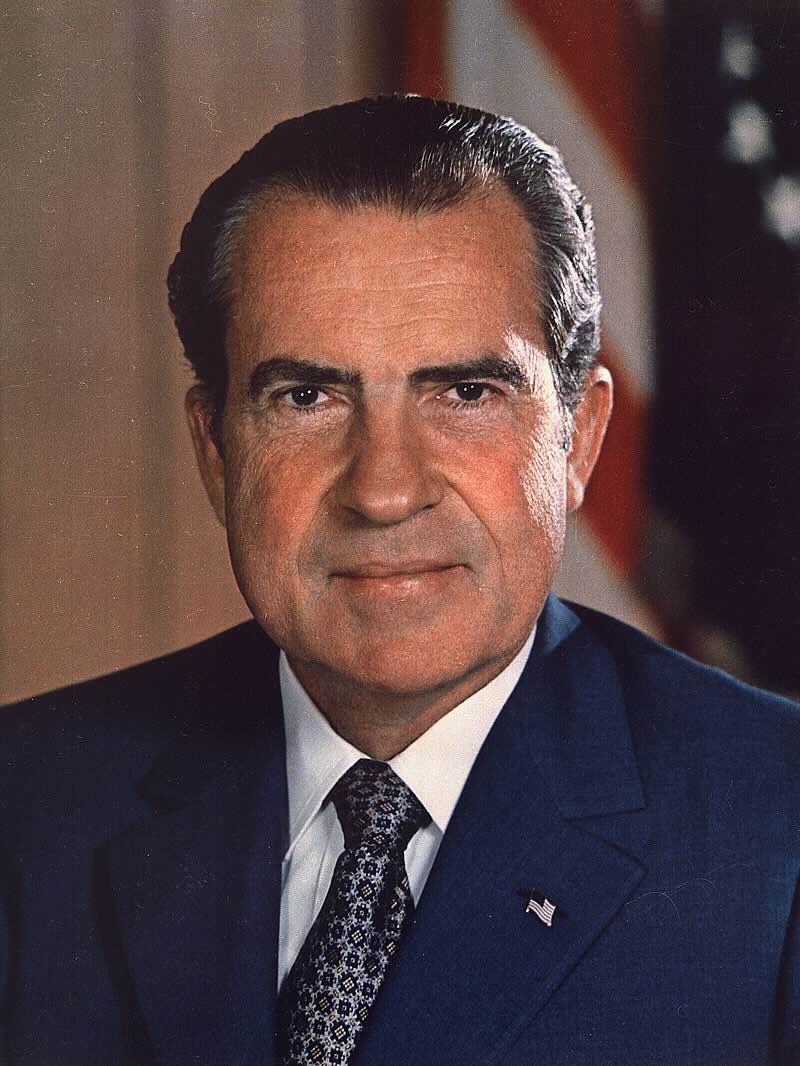

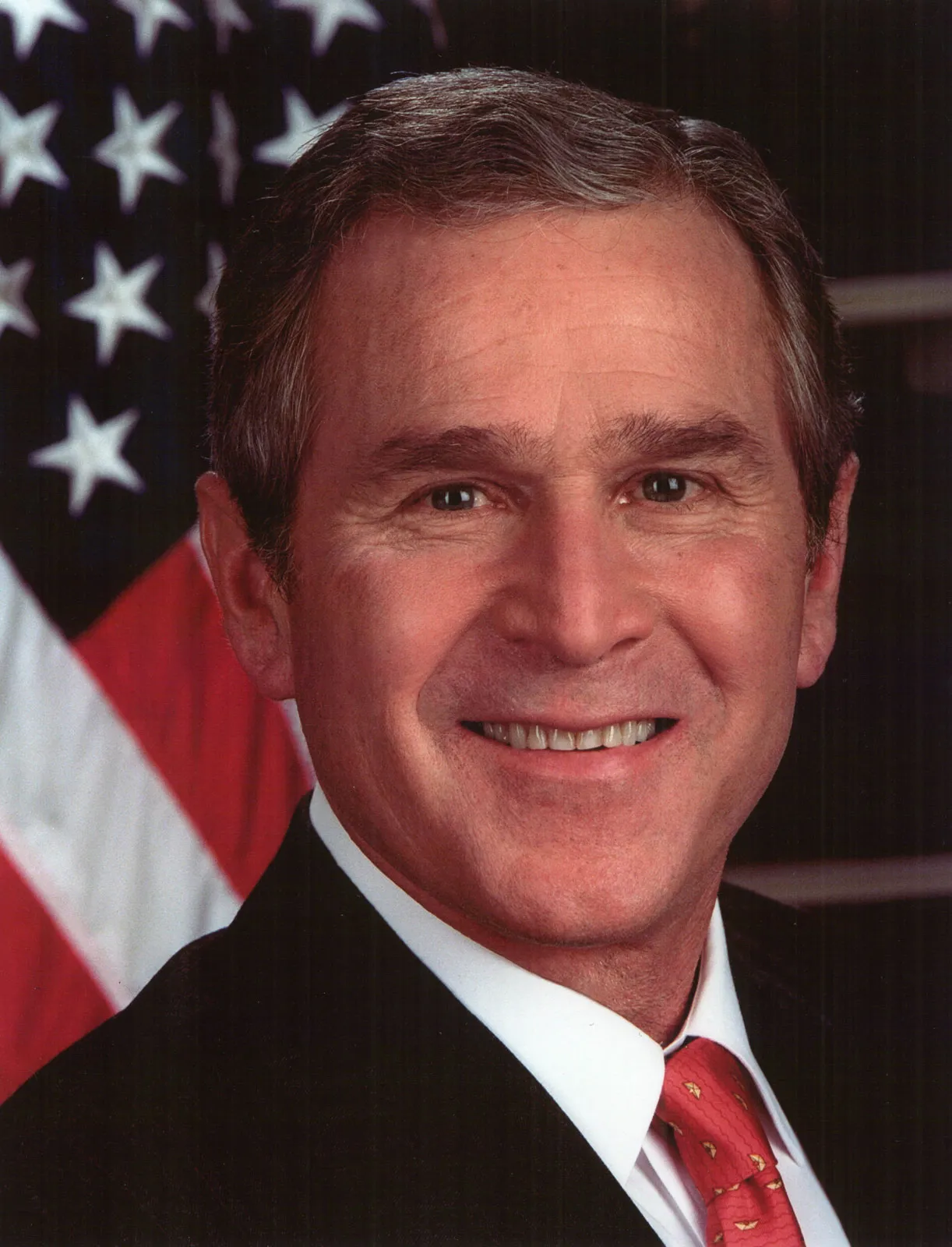

The growth of federal debt transcends party lines, driven by major events and policy decisions across administrations. From Cold War spending, through Medicare expansion, the 2008 financial crisis, to COVID-19 relief/stimulus—each era has added significantly to the national debt. Both Republican and Democratic administrations have overseen substantial increases, highlighting how fiscal challenges stem from structural bipartisan dysfunction in financial management.

National Debt

Quarterly data (1966-2024)

Medicare & Medicaid Creation

Vietnam War

End of Gold Standard

Oil Crises & Stagflation

Reagan Military Buildup

Clinton-Era Surpluses

War on Terror

Medicare Part D

2008 Financial Crisis & Recovery